Securing insurance coverage for a roof replacement can save you significant financial stress. While navigating insurance claims can seem daunting, understanding the process and knowing your rights can improve your chances of success. In this article, we’ll focus on how to get your insurance provider to cover the roof replacement cost.

What Does Roof Insurance Cover?

Most UK home insurance policies provide coverage for damages caused by unexpected events, including:

- Storm damage

- Falling trees or debris

- Fire

- Vandalism

However, general wear and tear or neglect may not qualify for a claim. Regular maintenance is crucial to keep your roof in good condition and ensure eligibility for insurance coverage.

Importance of Documenting Your Roof’s Condition

Insurers may request evidence of your roof’s pre-damage condition. Maintaining records, such as inspection reports and photos, can strengthen your claim and show that the damage wasn’t due to neglect.

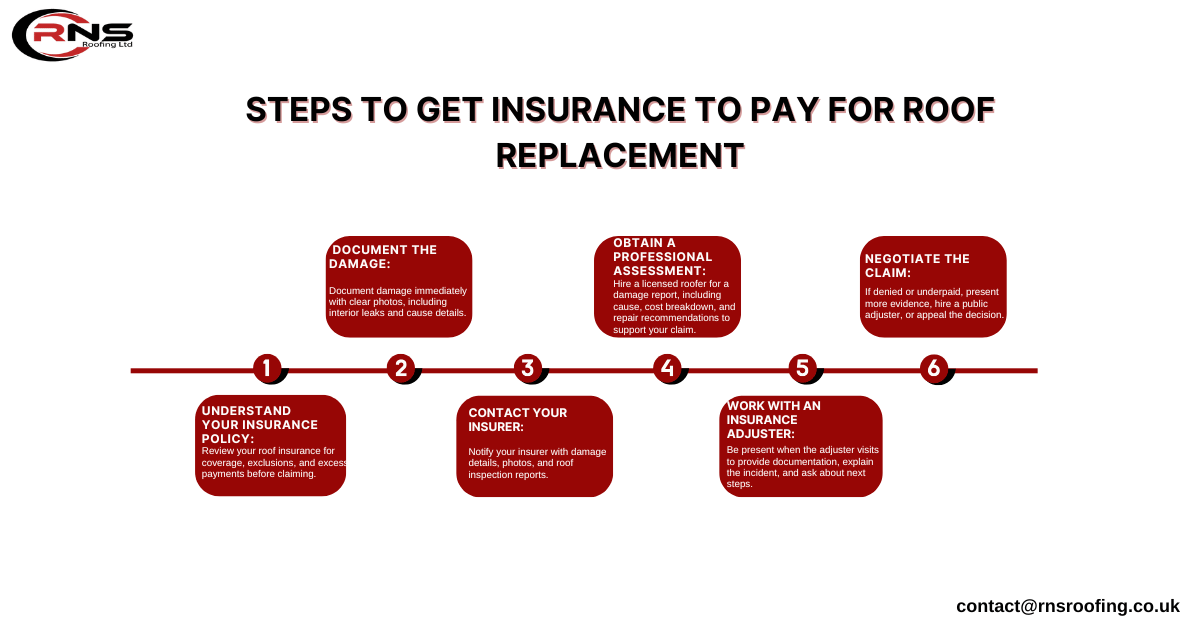

Steps to Get Insurance to Pay for Roof Replacement

1. Understand Your Insurance Policy

Review your roof insurance policy to understand the following:

- The extent of coverage

- Exclusions (e.g., aging roofs)

- Excess payments required

Knowing these details ensures you’re prepared before filing a claim.

2. Document the Damage

When damage occurs, immediately document it:

- Take clear photos of the affected areas.

- Include pictures of interior damages caused by leaks.

- Keep records of the date and cause of the damage (e.g., a storm or falling debris).

3. Contact Your Insurer

Notify your insurance provider promptly to initiate the claims process. Provide the following:

- A detailed explanation of the damage

- Photos and any supporting documents

- A copy of your roof inspection reports

4. Obtain a Professional Assessment

Hire a licensed roofer to assess the damage and provide a report. Ensure the report includes:

- The cause of the damage

- A breakdown of the roof replacement cost

- Recommendations for necessary repairs or replacements

This report will support your claim and provide insurers with the required information.

5. Work with an Insurance Adjuster

Your insurer will send an adjuster to assess the damage. Be present during their visit to:

- Provide documentation

- Explain the incident

- Ask questions about the next steps

6. Negotiate the Claim

If your claim is denied or the settlement offer is insufficient to cover the average roof replacement cost, you can:

- Present additional evidence

- Hire a public adjuster

- Appeal the decision

Average Roof Replacement Cost in the UK

The average cost of roof replacement in the UK varies based on several factors:

- Roof Size: Larger roofs cost more to replace.

- Material: Slate and tile roofs are more expensive than asphalt or metal.

- Labour: Costs vary by region and complexity of the installation.

On average, UK homeowners can expect to pay:

- £5,000–£7,000 for a terraced house roof

- £7,000–£10,000 for a semi-detached house

- £10,000–£15,000 for a detached house

These costs may include labour, materials, and VAT. Check with your insurer to understand how

much they’ll cover versus your out-of-pocket expenses.

Conclusion

These tips can help you navigate the insurance process effectively and secure coverage for roof replacement costs. For professional assistance, consider contacting local roofing experts or searching for reliable companies near you.

FAQs

What should I do if my insurance claim is denied?

You can appeal the decision by providing additional evidence, consulting a public adjuster, or seeking legal advice.

Does home insurance cover roof replacement costs in the UK?

Yes, if the damage is due to unexpected events like storms or fire. However, wear and tear or poor maintenance is typically excluded.

How often should I inspect my roof?

It is recommended that you inspect your roof at least once a year and after significant weather events to ensure eligibility for future claims.